Joint Stock Company A is an enterprise with 100% Vietnamese capital, established for more than 01 year, with 04 founding shareholders who are individuals. I am currently one of the founding shareholders of the company and hold 65% of the capital. For certain personal reasons, I wish to transfer the entire number of shares that […]

Question: I am preparing to establish an innovative startup enterprise, which is expected to generate revenue from innovation activities and may transfer contributed capital interests to investors. I request advice, under the new regulations, on cases eligible for corporate income tax exemption or reduction, from which year the incentive period is counted, and whether small […]

Question: I intend to establish a company to provide employment services. When registering the enterprise, which business line code must I register, and in order to operate in practice, is it necessary to obtain an Employment Service Operation License? If yes, what are the licensing conditions, what is the process and procedure, and which authority […]

Question: I have one child who, as of 2026, is 19 years old and is currently studying vocational training. Can this child be considered a dependent for family circumstance deduction purposes when calculating personal income tax ? Answer: Pursuant to Clause 4, Article 10 of the Law on Personal Income Tax 2025 (Law No. 109/2025/QH15), […]

Question: I have just reached the working age and want to join the labor market. What is the minimum wage I will receive? Recently I live in Hai Phong City. Answer: On November 10, 2025, the Government issued Decree No. 293/2025/ND-CP regulating the regional minimum wages applicable to employees working under labor contracts, effective from […]

Popular Posts

Registration fee for representative offices

Establishment of a Representative Office in Vietnam

Vietnam Green Labels under Vietnam Law

SB Law - News on VTV4

POINTS TO NOTE WHEN ORGANIZING EXTRA CLASSES

From February 14, 2025, Circular 29/2024/TT-BGDDT will officially take effect, replacing Circular 17/2012/TT-BGDDT. This new regulation introduces significant changes that teachers, schools, and extracurricular teaching

Procedures for Merging a Capital-Contributing Member in a Limited Liability Company with 100% Foreign Investment Capital

My company is a limited liability company with two or more members and 100% foreign capital operating in Vietnam. Currently, one of the company's capital

KEY UPDATES ON LAND LITIGATION IN THE LAND LAW 2024 COMPARED TO THE LAND LAW 2013

The Land Law 2024, which has came into effect on August 1, 2024, builds upon the 2013 Land Law and introduces significant changes in the

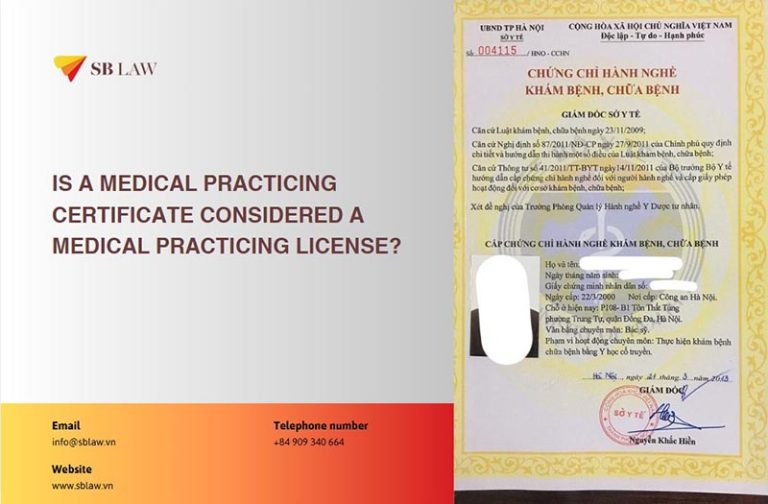

IS A MEDICAL PRACTICING CERTIFICATE CONSIDERED A MEDICAL PRACTICING LICENSE?

Question: I am planning to open a traditional medicine clinic and am preparing the application for a license to operate. According to regulations, the chief

What do i need to know before opening a traditional medicine clinic?

Question: I have a traditional medicine doctor's degree and a practice certificate issued on September 12, 2022 with a practice period of 12 months. I

Support for establishing a cosmetic clinic in Hanoi City

Question: We are seeking a professional law firm to assist in establishing a specialized aesthetic clinic in Hanoi. Answer: Based on the information provided by

Can overtime and night shift allowances be included in the trainee's payroll?

Question: In relation to the Apprenticeship Agreement we have, since we provide OT and Night shift allowance, would it be legal to include or having

Is developing software using artificial intelligence to predict lottery numbers illegal?

Question: I have developed a software that uses artificial intelligence to predict lottery results (but does not organize gambling or advertise for lottery) and only

SB Law participates in protecting the legitimate rights and interests of Clients in disputes over Deposit contracts for the transfer of land use rights in Ho Chi Minh City

SB Law has participated in protecting the legitimate rights and interests of Ms. L - the Defendant in the civil case “Dispute over deposit contract”