Joint Stock Company A is an enterprise with 100% Vietnamese capital, established for more than 01 year, with 04 founding shareholders who are individuals. I am currently one of the founding shareholders of the company and hold 65% of the capital. For certain personal reasons, I wish to transfer the entire number of shares that […]

Question: I am preparing to establish an innovative startup enterprise, which is expected to generate revenue from innovation activities and may transfer contributed capital interests to investors. I request advice, under the new regulations, on cases eligible for corporate income tax exemption or reduction, from which year the incentive period is counted, and whether small […]

Question: I intend to establish a company to provide employment services. When registering the enterprise, which business line code must I register, and in order to operate in practice, is it necessary to obtain an Employment Service Operation License? If yes, what are the licensing conditions, what is the process and procedure, and which authority […]

Question: I have one child who, as of 2026, is 19 years old and is currently studying vocational training. Can this child be considered a dependent for family circumstance deduction purposes when calculating personal income tax ? Answer: Pursuant to Clause 4, Article 10 of the Law on Personal Income Tax 2025 (Law No. 109/2025/QH15), […]

Question: I have just reached the working age and want to join the labor market. What is the minimum wage I will receive? Recently I live in Hai Phong City. Answer: On November 10, 2025, the Government issued Decree No. 293/2025/ND-CP regulating the regional minimum wages applicable to employees working under labor contracts, effective from […]

Popular Posts

Inquiry for Legal Advice Service

Setting up a marketing company in Vietnam.

Overview

Establishing a 100% foreign company in Vietnam

Question: We are considering to establish a new company in Vietnam. The company shall have 1 shareholder (foreign person, not Vietnamese) and this shall be a

Real estate project handover in Vietnam

Question: I am an individual, who has acquired a property in project stage in Nha Trang City and the handover is about to happen now. In

Work permit for international lawyer in Vietnam

Question: I'm seeking your kind advise regarding work permit. This is my first trip to Vietnam and I work as an English teacher. I've a new

Advising on obtain work permit for foreigner working in Vietnam

Question: I want apply for work permit for foreigner working in Vietnam. If you company can support us with this I would be grateful for

Consulting on providing company’s Legal paper for the third parties

Question: My company had agreed to rent an area to a company (“Tenant”) that provides serviced offices, virtual offices for their clients which are companies/ representative

Legal advice on housing ownership of foreigners

The Client is a foreign person who purchased a condominium unit in Vietnam in 2016 (the “Unit”) by way of entering into the Unit lease contract

Open company in Vietnam

Question: we are my planing open new company LLC IN YOUR COUNTRY HOW MUCH PRICE AND HOW MUCH COST ? Answer: I am Lawyer of

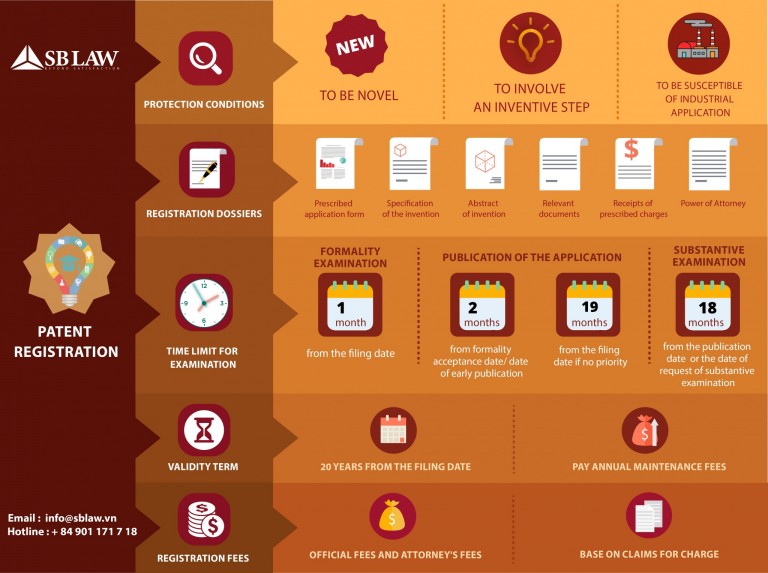

PATENT REGISTRATION IN VIET NAM

Question: Kindly provide us with your best quotation for Patent Registration in Vietnam. We look forward to hearing from you soon. Answer: Regarding your enquiries

Advice on setting up a foreign-invested company for trading veterinary medicine in Vietnam

Question: I want set up a foreign-invested company for trading veterinary medicine in Vietnam. If you company can support us with this I would be