Our company is a multiple-member limited liability company and is now planning to carry out the procedures to change its legal representative. Please advise what documents need to be prepared, the steps to be taken, the order of procedures, and the statutory processing time under current regulations. Answer: At the request of the Client, we […]

I intend to establish a Single-Member Limited Liability Company, in which I will be the sole owner holding 100% of the charter capital and directly managing the company’s operations. Under the new regulations on enterprise registration, enterprises are required to record information on their beneficial owner(s). In my case, how will the beneficial owner be […]

I am a shareholder of a joint stock company with a charter capital of VND 500,000,000, divided into 500,000 common shares. Accordingly, the total number of voting shares of the Company is 500,000. The specific ownership structure is as follows: Mr. A holds 200,000 common shares; Mr. B holds 200,000 common shares; and Mr. C […]

Question: Our company is a wholly foreign-owned enterprise and is currently planning to cooperate with a Vietnamese company to jointly invest in and operate a nursing home providing elderly care services. May I ask whether the current laws of Vietnam allow foreign companies to participate in this field? Answer: According to Appendix I on the […]

Our company currently has a product in the form of a nasal spray and is considering an appropriate registration route for market circulation. The company would like to know whether this product can be registered as a medical device. Answer 1. Can the product be registered as a medical device? According to Clause 1 Article […]

Popular Posts

Registration of Trademark and Copyright

Lawyer Nguyen Thanh Ha lectures at Judicial Academy

Lawyer Nguyen Thanh Ha gave an interview on Invest TV channel

Quotation for Trademark Registration in Vietnam and Thailand

Amendment and Supplementation of Certain Provisions and Implementation Measures of the Law on Promulgation of Legal Documents

On May 25, 2024, the Government issued Decree No. 59/2024/NĐ-CP amending and supplementing certain provisions of Decree No. 34/2016/NĐ-CP dated May 14, 2016, which provides

Enhancing Thematic Communication on One-time Social Insurance

On May 22, 2024, Vietnam Social Security issued Official Letter No. 1488/BHXH-TT to enhance thematic communication on one-time social insurance. Vietnam Social Security requests provincial

Implement documents detailing the implementation of the Water Resources Law 2023

On May 23, 2024, the Ministry of Natural Resources and Environment issued Official Letter 3263/BTNMT-TNN on the implementation of guiding documents on the Law on

Value added tax policy

On May 20, 2024, the General Department of Taxation issued Official Dispatch 2125/TCT-CS 2024 on value added tax policy. Accordingly, in case the Company signs

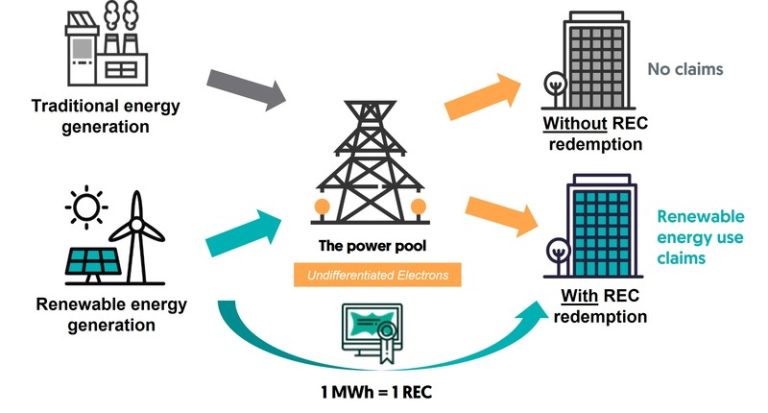

Tax policy for REC certificates

On May 20, 2024, the General Department of Taxation issued Official Dispatch 2127/TCT-CS 2024 on tax policy. About VAT The General Department of Taxation has

Corporate Income Tax Incentives

On May 20, 2024, the General Department of Taxation issued Circular 2133/TCT-CS 2024 regarding tax policies. Based on the amended Law No. 32/2013/QH13, which supplements

Clarification on Land Rental Policies

On May 20, 2024, the General Department of Taxation issued Official Dispatch 2128/TCT-CS 2024 on answering land rental policies. Pursuant to the 2013 Land Law,

Opinion on Value Added Tax (VAT)

On May 20, 2024, the General Department of Taxation issued Circular 2132/TCT-CS 2024 regarding Value Added Tax (VAT). The Circular requests that the provincial Tax

Problems with tax policy

On May 16, 2024, the General Department of Taxation issued Official Dispatch No. 2087/TCT-CS on tax policy problems. About Value Added Tax (VAT) Based on