Question: What risks might my company face if we do not complete the VNeID electronic identification process?

Answer:

Cording to Clause 4, Article 40 of Decree No. 69/2024/NĐ-CP issued by the Government, starting from July 1, 2025, all organizations and enterprises will be required to log in to the Electronic Tax System and online public service portals using electronic identification accounts (VNeID) managed by the Ministry of Public Security. Accounts previously issued through the National Public Service Portal or by the information systems for administrative procedure resolution at the ministerial or provincial level will expire after June 30, 2025.

Therefore, enterprises that fail to complete their VNeID registration before July 1, 2025 will be unable to access the electronic tax system (at [thuedientu.gdt.gov.vn]) to perform key functions such as tax declaration, tax payment, tax refund, or other online services provided by the tax authoritie. Failure to complete VNeID registration on time will prevent the company from accessing the electronic tax platform, filing or paying taxes, and performing other administrative procedures — resulting in legal, financial, and operational risks.

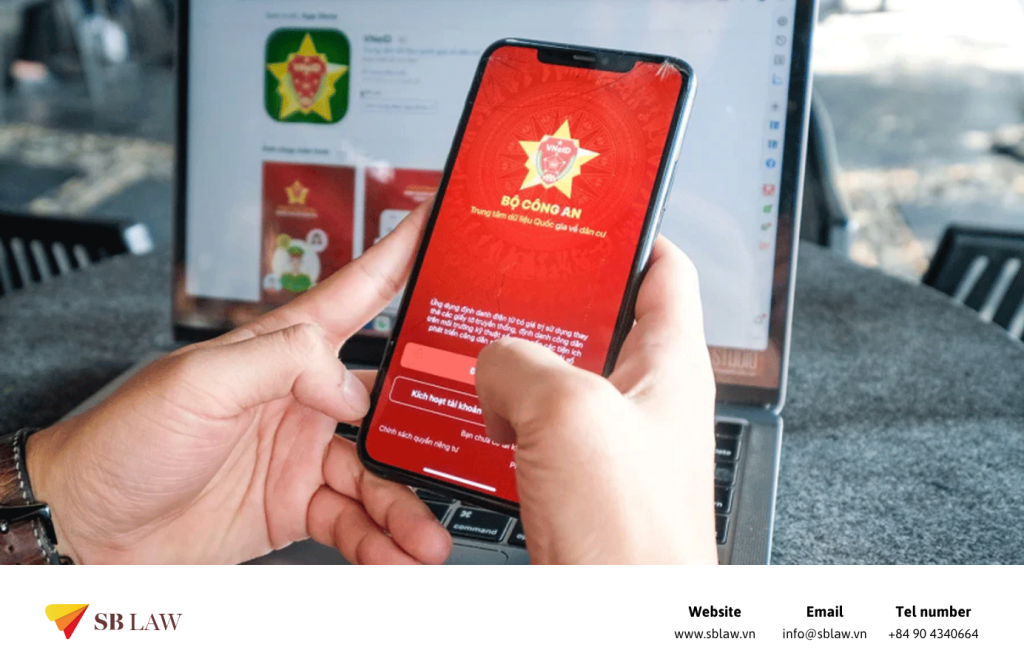

Therefore, the company should promptly register for an organizational VNeID account in accordance with Article 12 of Decree No. 69/2024/NĐ-CP. The registration can be completed online through the VNeID application or by submitting documents directly to the competent public security authority to ensure seamless and uninterrupted connectivity with national administrative systems.

Consultation reference: Company services