Question: I have one child who, as of 2026, is 19 years old and is currently studying vocational training. Can this child be considered a dependent for family circumstance deduction purposes when calculating personal income tax ? Answer: Pursuant to Clause 4, Article 10 of the Law on Personal Income Tax 2025 (Law No. 109/2025/QH15), […]

Question: I have just reached the working age and want to join the labor market. What is the minimum wage I will receive? Recently I live in Hai Phong City. Answer: On November 10, 2025, the Government issued Decree No. 293/2025/ND-CP regulating the regional minimum wages applicable to employees working under labor contracts, effective from […]

Criteria Circular No. 200/2014/TT-BTC Circular No. 99/2025/TT-BTC Effectiveness - Effective from 01 January 2015. - Circular No. 200/2014/TT-BTC is only partially repealed upon the effectiveness of Circular No. 99/2025/TT-BTC, except for the provisions on accounting for the equitization of State-owned enterprises, which remain effective until replaced by a separate regulatory document (pursuant to Clause 2, Article 31 […]

Question: Our company has multiple legal representatives. Currently, the company needs to enter into a labor contract with one of these legal representatives in order to appoint him/her to a specific managerial position. Under the latest regulations, does one legal representative of the Company have sufficient authority to represent the enterprise in signing a labor […]

Question: I am currently the Director and legal representative of Company A (a single-member limited liability company wholly owned by Corporate Entity C in Norway). At present, Company B is carrying out dissolution procedures in Vietnam. During this transitional period, my salary is being paid directly by the parent company until the dissolution of Company […]

Popular Posts

Forms of works protected under the form of copyright in vietnam

Legal advice for amendment of Investment Certificate and Certificate of Enterprise

New points in Law on Enterprise (Amended)

Establishing a Business and Choosing a Business Type

Question: Dear Lawyer, if I want to establish a single-member limited liability company (LLC) with an individual member, are there any restrictions on the minimum

Conditions and procedures for establishing a foreign-invested company (FIC) in Vietnam in the fields of security services and laundry services.

Question: Dear lawyer, I would like to receive advice on the conditions and procedures for establishing a foreign-invested company (FIC) in Vietnam in the fields

Is a traffic accident on the way home from work considered a work-related accident?

Question: Dear Lawyer, an employee of our company was involved in a traffic accident on their way home from work, resulting in injuries. The accident

Can employees work 11 hours of overtime per day due to an IT incident?

Question: Dear Lawyer, The Information and Communications Technology (ICT) department of our Company has recently encountered an operational incident, and as a result, the ICT

Consultation on payment for unused leave

Question: Dear Lawyer, our company is facing several resignation cases with legal violations as follows: Disappearance: Some employees abandoned their shifts for more than five

Issues related to land rent reductions

Question: We kindly ask for your consultation regarding issues related to the reduction of land rent. In which stages will land rent be reduced? Are

Are there any restrictions on foreign ownership ratios in Joint venture real estate development projects?

Question: According to Vietnamese regulations regarding investment projects related to land and real estate development and business, are there any limits on the ownership ratio

The issue of Authorization in Enterprises

Question: Dear Lawyer, can the authorized representative of a shareholder/member delegate their rights and obligations to another person? (The delegation follows the diagram below: Foreign

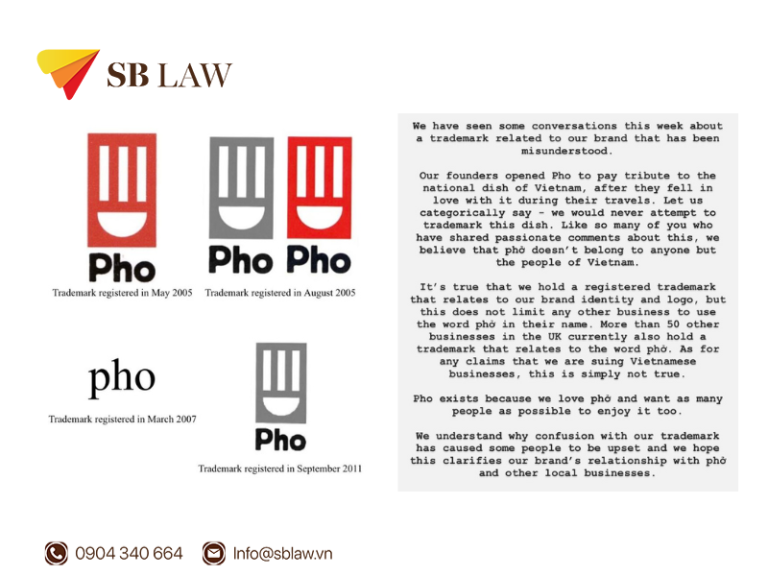

"PHO": A CULTURAL ICON AND THE TRADEMARK CONTROVERSY IN UNITED KINGDOM

Pho is widely celebrated as the quintessential national dish of Vietnam, symbolizing the country’s rich culinary heritage and enjoyed by people of all backgrounds. In