Question: I have one child who, as of 2026, is 19 years old and is currently studying vocational training. Can this child be considered a dependent for family circumstance deduction purposes when calculating personal income tax ? Answer: Pursuant to Clause 4, Article 10 of the Law on Personal Income Tax 2025 (Law No. 109/2025/QH15), […]

Question: I have just reached the working age and want to join the labor market. What is the minimum wage I will receive? Recently I live in Hai Phong City. Answer: On November 10, 2025, the Government issued Decree No. 293/2025/ND-CP regulating the regional minimum wages applicable to employees working under labor contracts, effective from […]

Criteria Circular No. 200/2014/TT-BTC Circular No. 99/2025/TT-BTC Effectiveness - Effective from 01 January 2015. - Circular No. 200/2014/TT-BTC is only partially repealed upon the effectiveness of Circular No. 99/2025/TT-BTC, except for the provisions on accounting for the equitization of State-owned enterprises, which remain effective until replaced by a separate regulatory document (pursuant to Clause 2, Article 31 […]

Question: Our company has multiple legal representatives. Currently, the company needs to enter into a labor contract with one of these legal representatives in order to appoint him/her to a specific managerial position. Under the latest regulations, does one legal representative of the Company have sufficient authority to represent the enterprise in signing a labor […]

Question: I am currently the Director and legal representative of Company A (a single-member limited liability company wholly owned by Corporate Entity C in Norway). At present, Company B is carrying out dissolution procedures in Vietnam. During this transitional period, my salary is being paid directly by the parent company until the dissolution of Company […]

Popular Posts

Employment contract under Vietnam Labor Code

New policies will take effect from June 2022

The Vietnam Civil Law Code 2005

DISPUTE RELATED TO THE CONTRACT OF SERVICE

Termination of a Labor Contract Upon Expiry

Question: Our company signed a fixed-term labor contract with a foreign employee for a duration of 12 months, with salary adjustments made via an annex.

Working Hours Per Week and Standard Working Days

Question: Dear Lawyer, in our company's internal regulations and labor agreements, the following is stated: "1. Working hours: 08:00 - 17:00, lunch break from 12:00

Risks Associated with Terminating an Employment Contract Due to Corporate Restructuring

Question: Dear Lawyer, Our company is undergoing a restructuring process, and it is highly likely that we will need to terminate an employment contract with

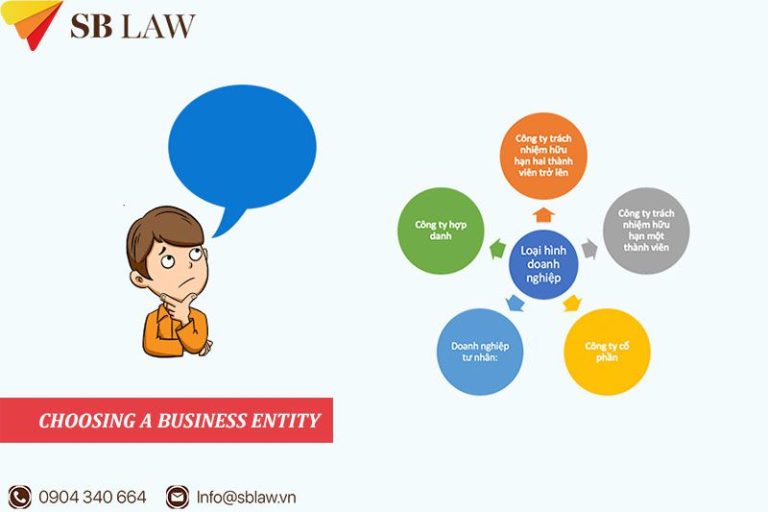

Choosing a Business Entity

Question: I am considering whether to establish a joint-stock company or a single-member limited liability company. Could you please provide an analysis of the advantages

Termination of the Labor Contract with an Employee

Question: Dear Lawyer, our Company has entered into a fixed-term Labor Contract with an employee. However, due to changes in our business structure, the Company

Labor Regulations

Question: Our company has issued labor regulations but has not registered them with the Department of Labor, Invalids, and Social Affairs. Can these regulations serve

Rights and Legality of Job Reassignment Contrary to the Signed Employment Contract

Question: I was hired as an accountant under a signed employment contract, which clearly specifies the job title and position as an accountant in the

Dismissal of Board of Directors Members When Not Provided for in the Company's Charter

Question: Our company intends to dismiss a member of the Board of Directors, but the company's charter does not provide any provisions for dismissal. Specifically,

Case of Moving Imported Goods Out of the Storage Location Before Official Inspection Certification

Question: Dear Lawyer, Our company imports goods listed under the categories specified in Circular No. 41/2018/TT-BGTVT. The inspection officers have conducted an on-site check; however,