Decree on Non-Cash Payments

On May 15, 2024, the Government issued Decree No. 52/2024/NĐ-CP, which regulates non-cash payments. The key provisions of the Decree are as follows: - Opening and Utilization of Payment Accounts: Establishing and authorizing the use of payment accounts, Sealing and closing payment accounts, The Decree also outlines the opening and utilization of payment accounts by […]

The Decree details several articles of the Law on Consumer Rights Protection

On May 16, 2024, the Government issued Decree No. 55/2024/ND-CP detailing a number of articles of the Law on Consumer Rights Protection. Some outstanding contents of the Decree are as follows: - Responsibilities of individuals conducting independent and regular commercial activities without having to register their business within markets and commercial centers; Responsibilities of organizations […]

Adjustment of Petroleum Prices

On May 16, 2024, the Ministry of Industry and Trade issued Circular No. 3250/BCT-TTTN regarding the management of petroleum business operations. The Ministry of Industry and Trade announces the base prices for commonly consumed petroleum products in the market as follows: E5RON92 Gasoline: Reduced by 508 Vietnamese dong per liter, now priced at 22,115 […]

Price framework for tax calculation for groups and types of resources with similar physical and chemical properties and guidance on resource tax.

On May 20, 2024, the Ministry of Finance issued Circular No. 41/2024/TT-BTC amending and supplementing some provisions of Circular No. 44/2017/TT-BTC regulating the price framework for resource tax calculation for groups and types of resources with similar physical and chemical properties and Circular 152/2015/TT-BTC guiding on resource tax. The Circular includes 3 articles: - Amendment […]

Value added tax policy

On May 20, 2024, the General Department of Taxation issued Official Dispatch 2125/TCT-CS 2024 on value added tax policy. Accordingly, in case the Company signs a contract to lease land and infrastructure to an export processing enterprise, the export processing enterprise will enjoy the tax policy for the non-tariff zone from the time of its […]

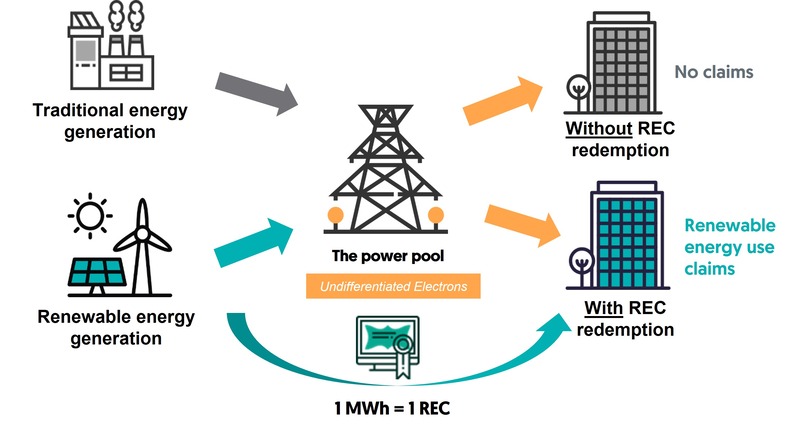

Tax policy for REC certificates

On May 20, 2024, the General Department of Taxation issued Official Dispatch 2127/TCT-CS 2024 on tax policy. About VAT The General Department of Taxation has Official Dispatch No. 4665/TCT-CS responding to the VAT policy on the transfer of REC certificates, in cases where the enterprise transfers the REC certificate that is not on the List […]

Corporate Income Tax Incentives

On May 20, 2024, the General Department of Taxation issued Circular 2133/TCT-CS 2024 regarding tax policies. Based on the amended Law No. 32/2013/QH13, which supplements certain provisions of the Corporate Income Tax Law No. 14/2008/QH12, and Decree No. 91/2014/NĐ-CP dated October 1, 2014, issued by the Government, which amends and supplements certain provisions related to […]

Clarification on Land Rental Policies

On May 20, 2024, the General Department of Taxation issued Official Dispatch 2128/TCT-CS 2024 on answering land rental policies. Pursuant to the 2013 Land Law, Decree No. 46/2014/ND-CP dated May 15, 2014 of the Government on land rent and water surface rent collection, Decree No. 123/2017/ND-CP dated May 14 /November 2017 of the Government amending […]

Opinion on Value Added Tax (VAT)

On May 20, 2024, the General Department of Taxation issued Circular 2132/TCT-CS 2024 regarding Value Added Tax (VAT). The Circular requests that the provincial Tax Department assess the actual documentation to determine whether the infrastructure sharing fee constitutes revenue from transmission and distribution activities related to the investment project for which a Certificate of Investment […]