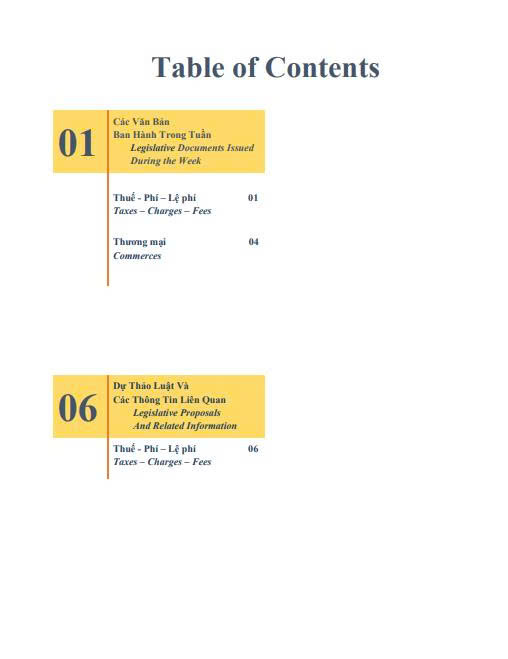

SBLAW is pleased to present to our valued readers the Law newsletter for Week 2 of July (07/7/2025 - 11/7/2025) with the following main contents:

1. Taxes – Charges – Fees

Decree No. 199/2025/ND-CP – Amendments to Export and Import Tariff Schedules

-

Adjusts preferential import tariff rates for several items:

-

Tin-mill blackplate (TMBP) steel: 0% import tax remains until August 2025, then increases to 7% from September 1, 2025.

-

Polyethylene goods previously taxed at 0% are now subject to a 2% import tax.

-

-

New Conditions for Preferential Tax Rates:

-

Automakers producing electric, hybrid, biofuel, and natural gas vehicles can include these units in volume calculations for tax incentives.

-

Companies holding more than 35% capital in licensed car manufacturers can aggregate production for tax incentive assessments.

-

False declarations are subject to tax collection and penalties.

-

-

Effective Date: July 8, 2025

2. Commerce

Circular No. 44/2025/TT-BCT – Rules of Origin under AANZFTA

-

Issued by the Ministry of Industry and Trade on July 7, 2025

-

Specifies requirements for:

-

Certificates of Origin (C/O): must include exporter info, shipment details, 6-digit HS code, origin criteria, FOB value, authority certification, and C/O reference number.

-

Self-declared origin documents: similar details, plus the qualified exporter ID and back-to-back certification (if applicable).

-

-

Effective Date: August 22, 2025

3. Draft Decree – Corporate Income Tax Law No. 67/2025/QH15

-

Issued on July 9, 2025

-

Key highlights:

-

Taxpayers:

-

Vietnamese enterprises (worldwide income)

-

Foreign enterprises (income from Vietnam, including e-commerce)

-

-

Taxable Income: includes income from business, capital transfers, asset sales, interest, marketing support, etc.

-

Tax-Exempt Income: includes income from:

-

Agricultural, forestry, fishery, salt production in disadvantaged areas

-

Vocational education for vulnerable groups

-

Scientific R&D, digital transformation, new tech commercialization

-

Enterprises with ≥30% disabled or HIV-affected employees

-

-

Deductible & Non-Deductible Expenses:

-

R&D: deductible up to 200% of actual cost

-

Non-deductible: penalties, excessive welfare, non-business assets, high-value passenger cars

-

-

Corporate Tax Rates:

-

20% (standard)

-

15%: revenue ≤ VND 3 billion/year

-

17%: revenue ≤ VND 50 billion/year

-

Preferential rates: 10% (15 years or permanent), 15%, 17% for priority sectors (high-tech, renewable energy, education, healthcare, etc.)

-

-

Tax Exemption & Reduction:

-

4-year exemption + 50% reduction for 9 years for 10%-taxed projects (15 years)

-

2-year exemption + 50% reduction for 4 years for 17%-taxed projects (10 years)

-

Newly registered businesses from household enterprises: exempt for 2 years from first taxable income.We invite readers to view the detailed legal newsletter here:Newsletter 2nd July, 2025

-

-