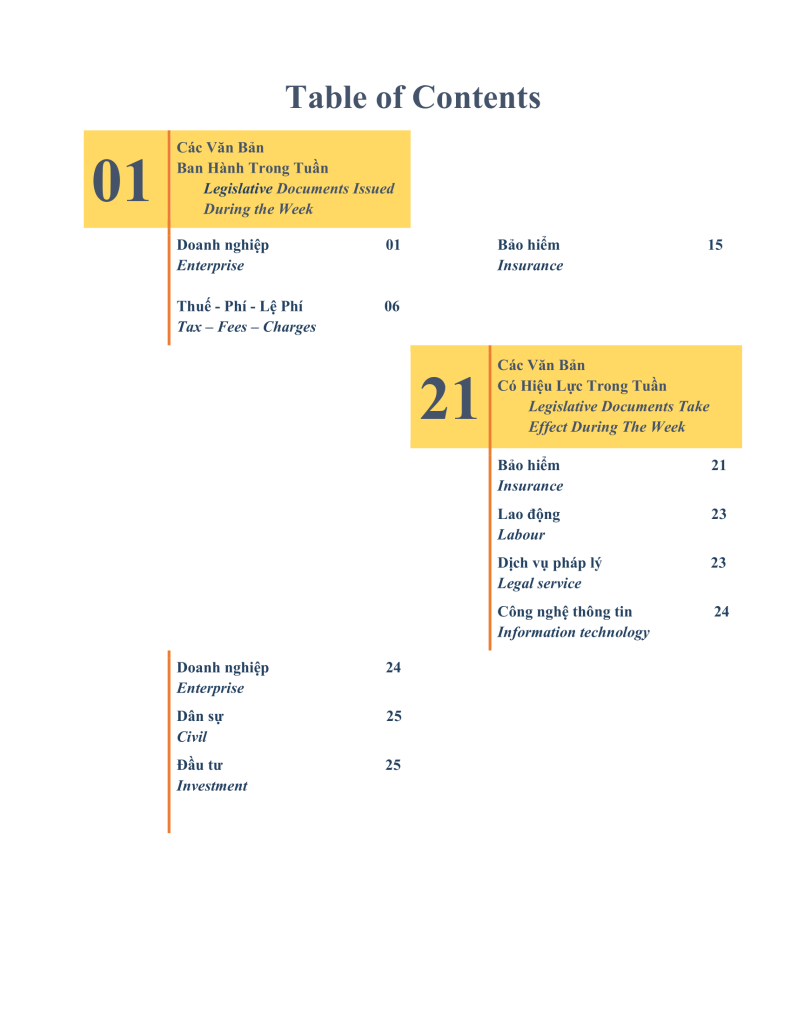

SBLAW is pleased to present to our valued readers the Law newsletter for Week 1 of July (30/7/2025 - 04/7/2025) with the following main contents:

-

1. Enterprise

-

Decree 168/2025/ND-CP: New rules on business name registration from July 1, 2025. Duplicate/confusing names not allowed.

-

Circular 68/2025/TT-BTC: Issued 80 templates for business registration and 28 templates for household business.

2. Taxes – Charges – Fees

-

Circular 69/2025/TT-BTC: VAT guidance applicable to foreign contractors operating in Vietnam.

-

Circular 64/2025/TT-BTC: 50% reduction in many fees (passport issuance, ID cards, fire safety inspections) from July 1, 2025 to December 31, 2026.

-

Decree 174/2025/ND-CP: 2% VAT reduction for goods/services taxed at 10% (except for specific sectors).

-

Decree 181/2025/ND-CP: Invoices ≥ VND 5 million must be paid via bank transfer to claim input VAT deduction.

3. Insurance

-

Circular 11/2025/TT-BNV: Details on when participants in voluntary social insurance can start receiving pensions.

-

Decree 176/2025/ND-CP: Provides monthly social pension allowance of VND 500,000 for those aged 75+ (and some aged 70–74).

We invite readers to view the detailed legal newsletter here:Newsletter 1st July, 2025

-