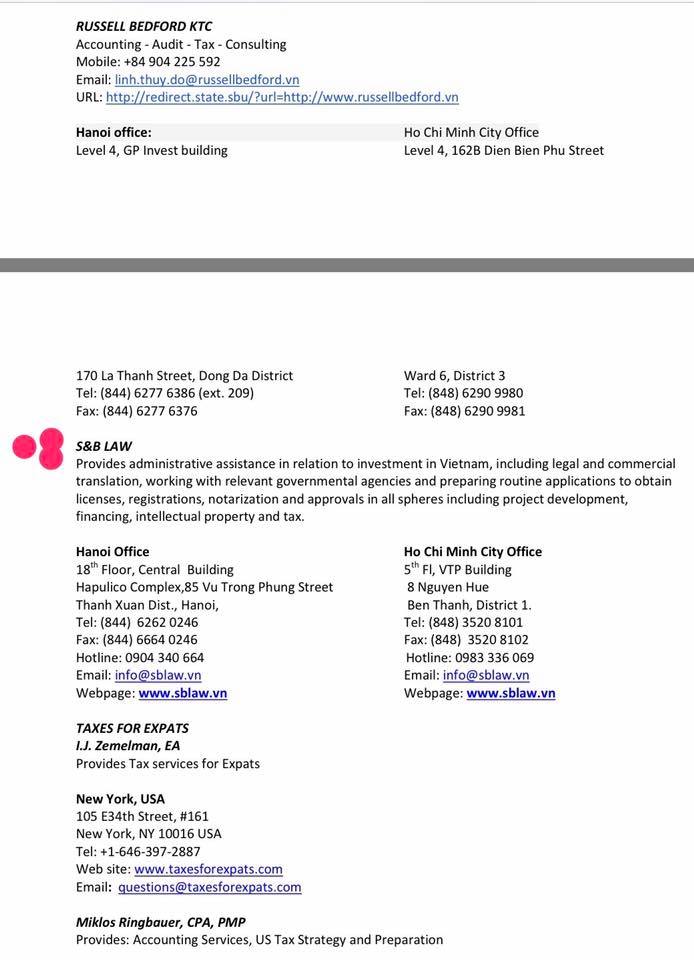

Provides administrative assistance in relation to investment in Vietnam, including legal and commercial translation, working with relevant governmental agencies and preparing routine applications to obtainlicenses, registrations, notarization and approvals in all spheres including project development, financing, intellectual property and tax.

Consultation on Social Housing Purchase

Question: I would like to purchase social housing. What should I pay attention to? Answer: To purchase social housing, you should take note of the