Establishing a travel company: what to prepare to operate legally?

Question: I am planning to establish a single-member limited liability company (LLC) in Thu Duc with a registered capital of approximately VND 1 billion and around 20 employees. The company intends to offer travel-related services, such as assisting international tourists visiting Vietnam, organizing tour packages, booking flights and hotels, and providing visa consultation services for […]

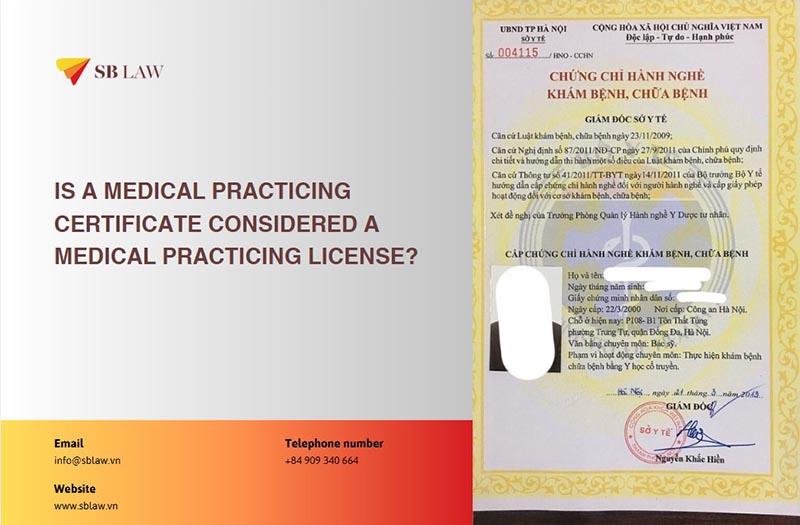

IS A MEDICAL PRACTICING CERTIFICATE CONSIDERED A MEDICAL PRACTICING LICENSE?

Question: I am planning to open a traditional medicine clinic and am preparing the application for a license to operate. According to regulations, the chief physician of a healthcare facility must be a licensed practitioner. However, I currently only have a practice certificate issued on September 12, 2022. I am not sure whether this certificate […]

What do i need to know before opening a traditional medicine clinic?

Question: I have a traditional medicine doctor's degree and a practice certificate issued on September 12, 2022 with a practice period of 12 months. I am currently updating my CME knowledge. I want to open a pharmacy selling finished non-prescription oriental medicine products in Dong Nai province, and also provide acupuncture and acupressure services. With […]

Support for establishing a cosmetic clinic in Hanoi City

Question: We are seeking a professional law firm to assist in establishing a specialized aesthetic clinic in Hanoi. Answer: Based on the information provided by the Client, we acknowledge that the Client intends to engage in spa services (including injection and invasive procedures), neck and shoulder massage, and vocational training. Pursuant to Clause 4, Article […]

Can overtime and night shift allowances be included in the trainee's payroll?

Question: In relation to the Apprenticeship Agreement we have, since we provide OT and Night shift allowance, would it be legal to include or having this benefit for trainees? Is it acceptable to add in the trainee's payslip the OT and Ngihtshift or need to just use training allowance? please advise po Answer: The company […]

Is developing software using artificial intelligence to predict lottery numbers illegal?

Question: I have developed a software that uses artificial intelligence to predict lottery results (but does not organize gambling or advertise for lottery) and only provides predictions based on mathematical statistics. If I charge users for this service, would it be considered a violation of any laws? Answer: According to current regulations, only lotteries recognized […]

CLOSING 2024 – A SPECIAL MILESTONE AT THE YEAR END PARTY IN HCMC (January 10, 2025)

On January 10, 2025, SBLAW hosted a memorable event in Ho Chi Minh City. This was not just a joyful and emotional Year End Party, but also a significant milestone that brought together representatives from our Hanoi and Ho Chi Minh City teams. Notably, the event also marked the signing of an important cooperation agreement, […]

Requirements and Procedures for Establishing a Foreign Law Firm in Vietnam

Question: We are a law firm established and currently operating in South Korea. To expand our market, we plan to invest in setting up a law firm in Vietnam. I would like to ask what conditions we need to meet, what procedures we need to follow, and whether our law firm in Vietnam can represent […]

Conditions and Procedures for E-commerce Websites and Applications to Operate in Vietnam

Question: We are a company with 100% foreign capital. We currently own a sales e-commerce platform including 01 website and 01 application for the purpose of allowing customers to order and pay. Check out the air conditioning products that we distribute. We want to know whether these websites and applications have been allowed to operate […]